Investing in Exchange-Traded Funds (ETFs) provides a broad range of opportunities for portfolio development. However, keeping track on the performance of your ETF holdings can be difficult. Thankfully, there are cutting-edge dashboards designed to optimize this process. These dashboards aggregate real-time data from numerous ETF providers, giving you a comprehensive view of your investments' trajectory.

- Harness interactive charts and graphs to rapidly recognize trends and shifts in ETF performance.

- Receive detailed return metrics, including past data and predictions for future growth.

- Compare the performance of various ETFs across industries, helping you make strategic investment decisions.

With a dedicated ETF performance dashboard, you can efficiently manage your investments and remain on track of market fluctuations.

Unveiling Profit Potential: Top ETF Tools for Traders

In the dynamic realm of trading, Exchange Traded Funds (ETFs) have emerged as a versatile instrument, presenting investors with diversified exposure to various asset classes. To maximize your ETF trading endeavors, it's essential to employ the right tools and strategies. Here are some of the top ETF tools that can help you conquer the market and unveil profit potential.

- Cutting-Edge Trading Platforms: A robust trading platform is fundamental for efficient ETF trading. Look for platforms that offer real-time market data, charting tools, order types, and research reports.

- Programmatic Trading Systems: For experienced traders, automated trading systems can optimize the trading process by placing trades based on pre-defined rules and algorithms.

- Technical Analysis Tools: Uncover potential ETF opportunities by employing fundamental, quantitative, and technical analysis tools. These tools can help you assess an ETF's trajectory and identify patterns.

- Comprehensive Resources: Stay informed about the latest ETF trends, market developments, and regulatory changes. Utilize educational resources, industry publications, and expert insights to deepen your knowledge.

Unveiling the Mysteries of ETFs: A Deep Dive into Investment Platforms

The complexities of the financial market can often leave investors feeling overwhelmed and unsure. Navigating the world of Exchange-Traded Funds (ETFs) requires a comprehensive understanding of their mechanics. This is where our innovative platform comes in. We offer a robust suite of tools designed to illuminate ETFs, empowering investors with the knowledge they need to make calculated decisions. Our platform provides instantaneous data, cutting-edge analysis, and intuitive interfaces, making ETF investing simpler than ever before.

- Discover the inner workings of ETFs with our detailed studies.

- Analyze your portfolio performance in real-time.

- Utilize our expert insights and advice to optimize your investment strategy.

Whether you are a seasoned investor or just begining out into the world of ETFs, our platform has something for everyone. Join us today and unveil your ETF investing potential.

Conquering Financial Markets with Powerful Tools

In the dynamic and often volatile world of financial markets, savvy investors rely on robust tools to analyze market trends and make informed decisions. These strategic instruments facilitate traders and investors to uncover opportunities, reduce risks, and ultimately enhance their returns. From quantitative analysis platforms to real-time market data feeds, a plethora of tools are available to support investors on their financial journey.

- Live Market Data: Accessing up-to-the-minute price fluctuations, news updates, and order book information is vital for making immediate trading decisions.

- Technical Analysis: Identifying patterns in historical price data can reveal potential future trends, helping investors make strategic trades.

- Financial Statement Review: Examining a company's financial health through its balance sheets, income statements, and cash flow statements provides valuable insights into its performance potential.

ETF Insights: Data-Driven Strategies for Success

In the dynamic world of investments, Exchange Traded Funds (ETFs) have emerged as a popular and versatile choice. Leveraging the Risk analysis for ETFs power of data is essential for success in this Dynamic landscape. Data-driven strategies enable investors to Analyze market trends, identify High-Growth opportunities, and make Strategic decisions. By Integrating advanced analytics and quantitative models, investors can gain a Significant edge in the ETF market.

- Sophisticated data analysis tools provide Real-Time insights into market movements and asset performance.

- Data-Based trading strategies can Optimize investment decisions, reducing emotional biases and maximizing returns.

- Risk Management strategies Leverage data to mitigate potential losses and enhance overall portfolio performance.

Navigating the ETF Market Analysis | A Comprehensive Guide

Embarking on your journey through the intricate world of ETF market analysis can feel daunting. However, with a strategic understanding of key factors, you can effectively navigate this complex landscape. Begin by identifying your investment goals and risk tolerance. This will influence your approach to ETF selection. Next, delve into fundamental analysis by examining the underlying assets of ETFs, analyzing their performance history, and researching the fund's track record. Technical analysis offers another valuable perspective, allowing you to understand price charts and trading volumes to detect potential opportunities and trends.

- Furthermore, keep a watchful eye on industry news and events that can influence ETF performance.

- Harness reputable financial resources, such as analyst reports and industry publications, to stay informed of the latest developments.

- Keep in mind that market analysis is an continuous process.

Regularly review and revise your investment strategy to accommodate with changing market conditions.

Christina Ricci Then & Now!

Christina Ricci Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Richard Thomas Then & Now!

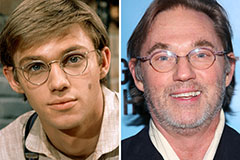

Richard Thomas Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!